Presidential remarks that trade negotiations with China have a long way go and his willingness to raise another 325 billion in tariffs did little to dissuade the bulls after Powell’s dovish speech in Paris raising hopes of a rate cut. Although choppy consolidation over the last couple days has maintained bullish trends, it seems to have also seemed to signal a wait and see attitude as earnings season continues to ramp up. Big tech will begin to join the earnings stage this afternoon with reports from EBAY, NFLX, and IBM. Keep in mind that NFLX has already warned it will miss analysts estimates.

Asian markets reacted negatively to the tough trade talk closing modestly lower across the board overnight. Currently, European markets are mixed but by and large slightly lower as they also ponder the difficulties ahead with Chinese trade negotiations. Despite that US Futures continue to put on a brave face indicating a very slightly bullish open fulled by hopes of a rate cut ahead of the Housing Starts report at 8:30 AM Eastern. Anything is possible, so plan your day very carefully and stay focused on price clues as they develop.

On the Calendar

On the Wednesday Earnings Calendar, we have 55 companies reporting quarterly results. Among the notable reports are AA, BAC, BK, CCI, EBAY, IBM, NFLX, KMI, NDLS, PNC, PGR, USB & WIT.

Action Plan

We have an interesting setup for this mornings market. The President yesterday remarked that the US/ China negotiations have a long way to go and went on to say he could impose an additional 325 billion in tariffs. However in a speech in Paris yesterday the Fed Chairman Powell reiterated a weakening global economy once again raising hopes of a rate cut. While Asian and European markets reacted negatively to the long road ahead on trade, the US futures choose to rally during the night on rate cuts. It would seem our priorities are very misplaced!

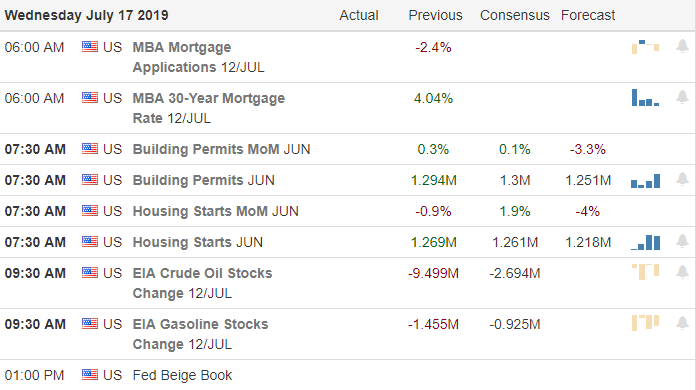

After 2-days of sideways chop, perhaps today with a big round of notable earnings reports the market can find the inspiration it needs to break the log jam. BAC has already topped estimates, but as of writing this report, investors appear unimpressed, and the stock is indicated lower. This afternoon EBAY, NFLX, and IBM will set the stage for the beginning of big tech earnings. Also, keep in mind, we have Housing Starts and the Petroleum reports on the economic calendar that may have a say in market direction.

Trade Wisely,

Doug

Comments are closed.