Hopes of an FOMC rate cut has set new record levels in the DIA, SPY, and QQQ, but now we will see how the rubber meets the road as earnings session begins. Can companies produce the traction that supports these lofty prices is the question? The big banks will dominate this week, but the bigger concern is how the big techs will fair amid the lingering trade war with China.

Overnight Asian markets managed to close with modest gains across the board even as the reviled the lowest quarterly growth figures in 27 years. European markets are also trading in the green this morning with modest gains across the board. As a result, the US Futures are pointing to a bullish open ahead of the Citigroup earnings report. Expect higher volatility in the days and weeks ahead with the possibility of large overnight gaps as markets react to actual earnings results.

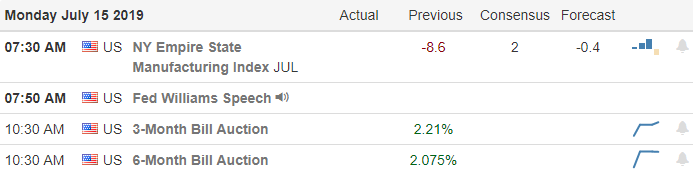

On the Calendar

The Earnings Calendar this week will be dominated by the big bank reports that kickoff the 3rd quarter earnings season today. Among the notable reports are C, JBHT & WTFC.

Action Plan

As third-quarter earnings season start rolling out today, we will find out if company results can support the dramatic increases in prices over the last couple months. An FOMC rate is one thing, but as China witnessed overnight, the trade war may have something say about earnings growth. China numbers revealed the slowest quarterly rate of growth in 27 years. US Economic indicators have continued to show strength however, many companies have already issued warnings that they will miss the analyst’s estimates.

With so many prices at new record highs, the pressure is on for earnings performance. We should expect significant volatility in the days and weeks as the market reacts to the actual results. The bigs banks are on deck this week with some of the big techs starting next week where most of the concern lies. The technicals of the DIA, SPT, and QQQ remain very bullish with the bulls firmly in control. Let’s hope their energic anticipation of a rate cut holds up as earnings begin to roll out beginning with Citigroup this morning before the bell.

Trade Wisely,

Doug

Comments are closed.