Fed chairman Jerome Powell will be front and center as he makes his rounds testifying on Capitol Hill. Most expect him to defend the Fed’s independence from the administration and of course many are hoping he will clarify the possibility of a rate cut. With such a strong Job number last week expectation of a 50 basis point cut has dropped significantly. Also, remember we could learn a bit more about the Fed’s thinking Wednesday afternoon with the release of last meetings minutes.

Asian markets closed mixed, but mostly lower overnight and European markets are currently seeing red across the board this morning. US futures are under some pressure this morning suggesting a lower open though recovering slightly from overnight lows. Of course, anything that might clarify a rate decision could move the market short of that I expect choppy price action to continue as we wait for the kickoff of 3rd quarter earnings season.

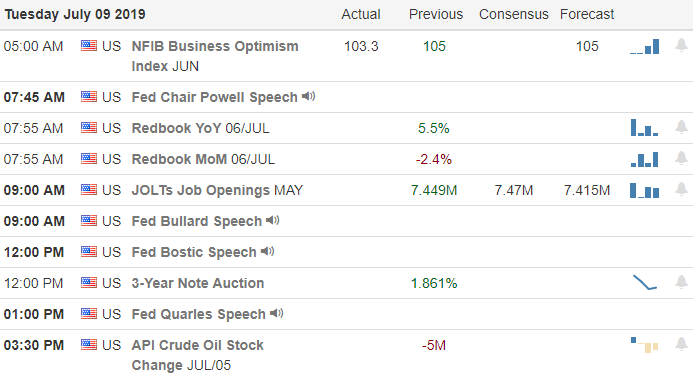

On the Calendar

We have just over 20 companies reporting on Tuesday’s Economic Calendar. Among the notable reports are AYI, JEF & SMPL.

Action Plan

Yesterday proved to be about as expected with the market taking a little break with choppy consolidation price action. Today Powell will begin a 3-day round of testimony in Congress where he is likely to defend the Fed’s independence from administrative meddling. All eye are on the Fed these days with the hope of a pending rate cut. There seems to be a revolving door on the news agencies with talking heads both for and against a cut. Even Cramer chimed in on the subject to say he is not sure there will be a cut. Perhaps we will learn more from the testimony and the release of the FOMC minutes Wednesday afternoon.

Futures are slightly under pressure this morning as tech’s slide south amid some downgrades. However, current trends remain bullish even though there are reasons to have a little concern with price patterns in the QQQ and IWM. I continue to expect mostly choppy price action that holds support levels as we wait for clarification on rate cuts and the kick off to earnings season.

Trade Wisely,

Doug

Comments are closed.