The concern I expressed regarding yesterday huge gap seemed to be shared by the majority of the market producing a pop and drop pattern on the day. Although the SP-500 inked a new record high the price action left behind more question than answers about the path ahead. Asian markets closed mixed overnight as Australia’s Central Bank cuts interest rates. European markets are flat to ever so slightly bullish this morning as the world looks for more details and clarity on US/China negotiations.

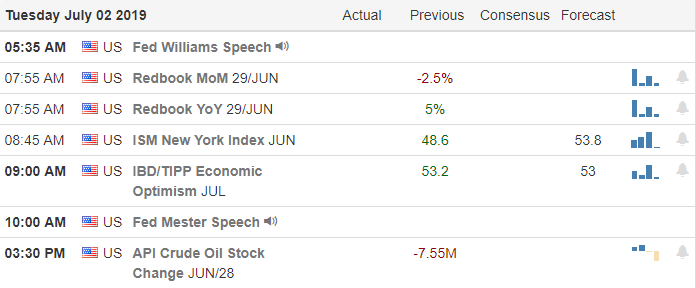

US Futures are currently flat to slightly lower this morning with very little to react to on both the Earnings and Economic calendars. Baring a market-moving news report don’t be surprised to light and choppy price action today with rapidly declining volume as traders head out to celebrate the 4th of July. There is a chance that condition lasts for the rest of the week. Keep in mind the market closes at 1:00 PM Eastern on Wednesday.

On the Calendar

On the Tuesday Earnings Calendar we have 14 companies reporting quarterly results. Among the notable reports AYI, JEF & SMPL.

Action Plan

It would seem my question about what had changed to create yesterdays huge gap up was shared by most of the market after printing pop and drop patterns on all major indexes. Although were was a late day rally to lift the indexes off the day’s lows yesterdays price action leaves more questions than answers to the path ahead. Further complicating the issue is the growing Iranian tensions, and the will they or won’t they question regarding interest rate cuts.

With little for the market to respond to today on the Economic Calendar and Earnings Calendar as well as the coming holiday futures are suggesting a flat to modestly lower open this morning. As I suspect many traders have already headed out to take advantage of some holiday vacation time don’t be surprised to see some very light choppy price action today will low volume. It will not be a surprise if this problem persists the rest of the trading week.

Trade Wisely,

Doug

Comments are closed.