With high hopes of future rate cuts and fingers crossed for a G20 trade deal to end the trade war, trade and investors push the SP-500 to new record highs. Now with tensions rising with Iran the question becomes can the other indexes follow suit and carve out new records as the weekend approaches. Although it seems very likely at this point that the markets desire new highs we should not rule out the possibility of some profit-taking to reduce weekend risk.

Asian markets closed mixed but mostly lower overnight and European markets are now modestly higher. US futures that were lower all night have been creeping up all morning trying to put on a brave face before the open an ahead of the Existing Home Sales report expected at 10 AM Eastern. As we head into the weekend I’m not sure possible reward is worth the risk of adding new positions today.

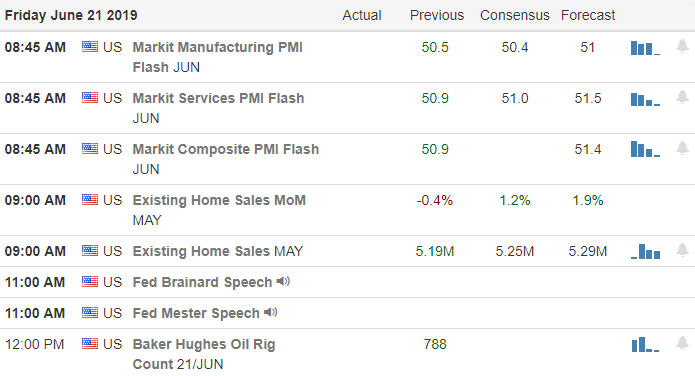

On the Calendar

On Friday’s earnings calendar we have three companies reporting quarterly results with only KMX notable.

Action Plan

Futures are taking a little rest this morning after the SP-500 closed at new record highs on the hope of future rate cuts. The DIA had a new closing high record and came very close to printing an all-time high for the index while the QQQ and IWM lag. According to reports the President had authorized retaliatory air strikes against Iran for the shooting down of a drown over international air space. However, the strike was called off but tensions continue to escalate.

After such a huge run-up in prices, mounting Iran tensions, the G20 just around the corner with hopes of a trade deal and facing a weekend buying new positions could be very difficult for traders. In fact there could be some profit-taking emerge to lower weekend risk as we move through the day. Currently future are pointing to flat or modestly lower open. I still think the market will seek out new record highs in the DIA and QQQ in the near future but I’m not sure the potential reward is worth the risk heading into the weekend.

Trade Wisely,

Doug

Comments are closed.