Friday’s big morning gap that ended up going nowhere as volume quickly dried up heading into a 3-day weekend left behind more questions than answers. While all four indexes remain in downtrends the Friday gap left behind indecisive candle patterns on the DIA and SPY while the QQQ printed a bearish engulfing just above key price supports. With futures currently pointing to flat or modestly lower open which way we go is anyone’s guess.

Although it would be nice to get some directional answers today it’s possible we could see another day of light and choppy price action as traders may have extended their holiday vacations through today. With the SPY and QQQ hovering near the midway point between their 50-day and 200-day averages stay flexible and focused on the price action for a directional clue. Remember that currently downtrends are still in force at this time.

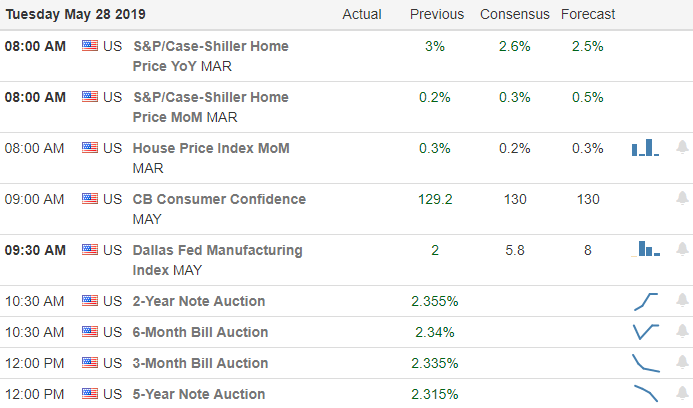

On the Calendar

We have less than 60 companies reporting earnings today. Notable reports include BNS, BAH, HEI, NIO, WDAY & YY.

Action Plan

Futures opened positive and remained positive most of the night with Asian markets closing positive across the board as Trump concluded his visit with Japan in hopes of striking a trade deal. Unfortunately, European markets are lower this morning on fresh worries of Italy’s growing deficit. It would seem the Italian concerns are also weighing on the US Futures as well in the pre-market, currently suggesting a modestly lower open.

Friday’s price action seems to have left more questions than answers with indecisive price action ahead of the 3-day holiday weekend. Although the QQQ finished Friday holding onto key support levels it also left behind a concerning bearish engulfing pattern as concerns that the trade war may transition into a tech war with China. Although hopeful for better price action today it would not be abnormal to see struggle with light volume as many traders extend their holiday vacation one more day.

Trade Wisely,

Doug

Comments are closed.