Stalled US/China trade negotiations continue to ripple around the world as the nervous tensions grow amidst the uncertainty of it all. After the blacklisting of Huawei’s devices, Google has suspended business activity with the Chinese device maker essentially blocking it from global growth and inflaming already difficult negotiations between the countries.

Tensions are also on the rise with Iran with the president’s warning of the end of Iran if they raise arms against the US. As John Wayne would say, they’s fightin’ words! Hopefully cooler heads will prevail but once again the uncertainty is not something the market likes so keep an eye on the VIX if fear begins to grow. A failure at the 50-day average in the index chart creates significant technical and psychological damage that can take weeks if not months to repair. Choose your risk carefully.

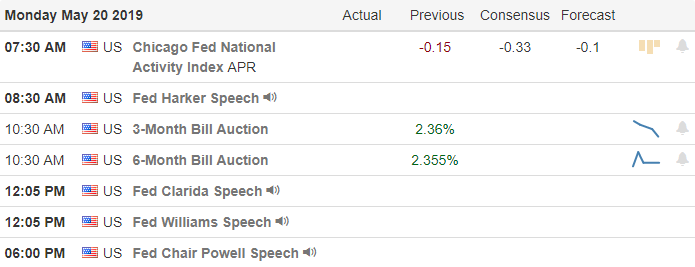

On the Calendar

On the Earnings calendar we have 80 companies expected to fess up to results. Notable earnings include IGT, TTM & TI.

Action Plan

Futures that initially pushed higher by nearly 120 points in early trading reversed overnight as trade war tensions continue and saber rattling with Iran grew over the weekend. Potentially damaging technical price patterns let behind on Friday’ index charts could bring out the bear this morning unless there is something that can inspire the bulls in the lead up to today’s open.

Unfortunately there is nothing on the economic calendar to inspire and although there are some notable earnings reports today they are unlikely to market moving events. That means the market will likely be very sensitive to news reports and tweets today opening the door to volatile price action. Remember is unwise to chaise a gap so let’s wait and see if sellers come in to support the gap before making any new trade decisions.

Trade Wisely,

Doug

Comments are closed.