With yesterday’s close leaving behind bearish engulfing candles and one would expect price to follow-through lower this morning but amidst such data-driven confusion futures are currently suggesting a modestly bullish open. That’s the nature of earnings season. Anything is possible making it near to impossible for the swing trader or position trader to hold on to an edge and becomes much more like a casino.

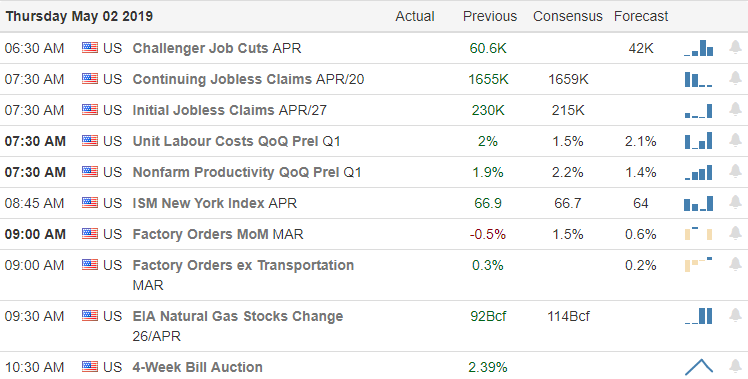

With more than 400 companies reporting and several possible market-moving economic reports this morning we should expect the data-driven confusion to continue accompanied by its best friend volatility. Keep in mind, we have the big Employment Situation number before the bell on Friday so plan your risk accordingly and be very careful not to over-trade.

On the Calendar

Today will be the biggest day of the week on the earnings calendar with more than 400 companies reporting. Notable reports include, ATVI, WTR, ANET, AVP, BLL, CBS, CI, ED, WW, DISCA, DWDP, DNKN, EXPE, FRT, GILD, HBI, HLF, HFC, IEP, K, MELI, MNST, MUR, NRG, PCG, PLNT, PPL, RMAX, SHAK, DATA, UAA, X, W, & ZTS.

Action Plan

After some significant bearish price action in reaction to the Fed Chairs comments yesterday afternoon leaving behind bearish candle patterns I was expecting at least little follow-through down this morning. However, as I write this the futures are modestly bullish even though Asian markets closed mostly lower and the European markets are currently trading mostly lower. Perhaps its nothing more than high hopes for good results from the more than 400 earnings reports today.

It also makes me wonder if yesterday’s selling got enough traders short to engineer a short squeeze attempt trying to get that new record high in the Dow. In light of the price action we must also consider the possibility of a pop and drop pattern. Have I mentioned I hate earnings! With so much data tossed at the market the fact is anything is possible and swing traders have very little edge in this kind of environment. Stay focused on price action, remain flexible and guard yourself against over-trading.

Trade Wisely,

Doug

Comments are closed.