Futures opened trading very bullish last night on optimism as the US/China trade negotiations resume in Washington DC today. The good vibes were significantly enhanced during the night when better than expected Chinese manufacturing data came to light. Not surprisingly, Asian markets closed sharply higher last night and European markets are strongly bullish this morning ahead of yet another Brexit vote.

Perhaps this is the bullish shot in the arm we have been waiting for to provide the momentum required to break through the index price resistance that has proved so stubborn over the last few weeks. Keep in mind, we still have a full plate of economic and earnings data for the market to digest this morning that could either enhance or subdue how the market open. Be careful to avoid chasing the morning open with the fear of missing out. Watch and wait for price action to prove buyers will step in to support the gap. Remember gaping into price resistance can produce those nasty pop and drop patterns so it’s wise to exercise a little patience this morning.

On the Calendar

We have 164 companies reporting on the first day of the 2nd quarter. Among the notable reports CALM, DGLY & KODK.

Action Plan

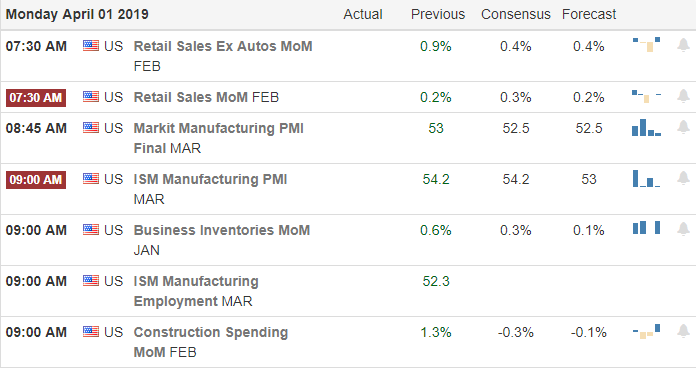

Stronger than expected Chinese manufacturing data and optimism as the US and China resume trade negotiations today in Washington DC has futures signaling a substantial morning gap up open today. Asian markets closed bullish across the board last night and European markets are also sharply higher this morning ahead of another Brexit vote. We also have a busy Economic Calendar this morning Retail Sales, PMI Manufacturing, Business Inventories, ISM Mfg. Index and Construction Spending for the market to digest.

As I write this the Dow futures indicate a gap of more than 175 points but at one point it was more than 200 points. If this bullishness holds, index charts will be gapping above some price resistance levels or will be very near then at the open. Keep an eye on the US points this morning that has the possibility of enhancing or subduing the bullishness. Technically this could be the burst fo bullish momentum to finally breakthrough the resistance above that has proved to be such a stubborn obstacle for the last few weeks. With that said be careful not to chase the gap up open. Let’s wait to see if the buyers support the gap because the last thing we would want to see is a pop and drop pattern.

Trade Wisley,

Doug

Comments are closed.