With an ugly decline yesterday I think most traders went into the close hoping the Friday Employment Situation number would get the bulls back on the job. Unfortunately China’s very disappointing trade numbers last night has the markets around the world reacting significantly lower as the global slowdown theme continues to spread.

Futures are pointing to a gap down of more than 100 points but that could greatly improve or get worse depending on the economic reports at 8:30 AM Eastern. This has obviously been a rough week for the market and the failure has key resistance levels does not help the technical picture of the market. Consider carefully the risk you carry into the weekend keeping in mind that we’ve still could hear about a US/China trade deal.

On the Calendar

A little slower day on the Friday earnings calendar with just under 60 reports today. No particularly notable except maybe MTM today.

Action Plan

Looking at the futures this morning I wish I had held more of the hedge positions through today. Futures were lower but pretty benign until China released trade numbers that were sharply lower than expected. Asian markets closed sharply lower and currently European are also declining across the board.

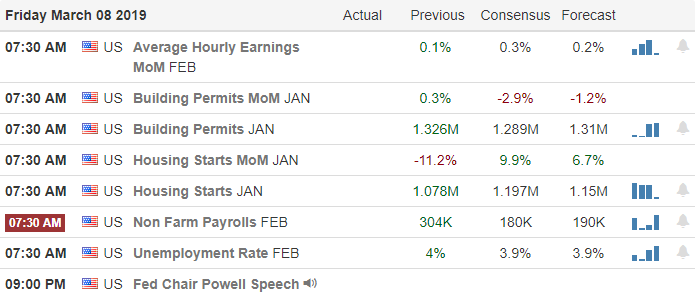

Today is the big Employment situation number. Estimates expect 180k jobs created and that the unemployment rate will tick down to 3.9 %. That would be a very good number but sharply lower than 304K reading last month. We also have the Housing Starts number that disappointed on the last reading so keep a close eye on the futures at 8:30 AM eastern as the open could improve or get worse very quickly, Consider the risk you hold into the weekend and remember we’ve yet to hear news on the US/China trade deal. Have a great weekend everyone.

Trade Wisely,

Doug

Comments are closed.