While the market waits for details of the US/China negotiations the price action has become very light and choppy and there is a danger of over-trading a dull market. Traders can easily become bored during choppy markets talking themselves into trader they would normally avoid just to have something to do and break the boredom.

If the overall market is patiently waiting perhaps we should do the same. Eventually the stalemate will be broken and the market could suddenly move either up or down. Unfortunately, that big move often happens overnight and the result can be very costly if you find that you’re on the wrong side of the move. Exercise your discipline, stay focused on price action and carefully weigh the risks of over-trading a dull market.

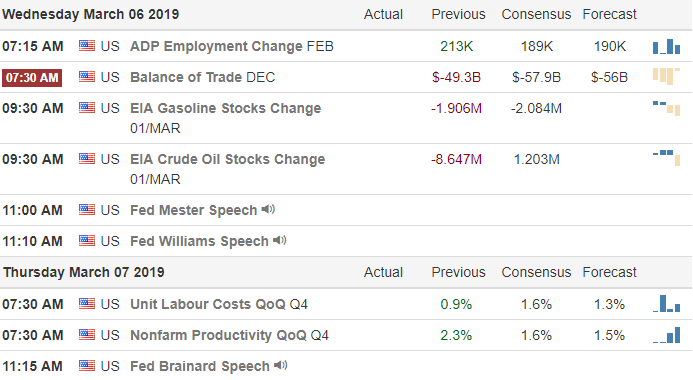

On the Calendar

On the Earnings Calendar we have more than 120 companies reporting. Notable reports are, ANF, AEO, BJ. BKCC, BREW, DLTR, SWRE & RST.

Action Plan

Yesterday was a mind-numbingly boring day with light volume chop as the market waits for news on the trade deal. The entire range of the DIA yesterday was less than $1.50 closing just 0.09 cents below the open of the day. There are certainly very good looking stocks but keep in mind a single new report could move the market substantially so be careful not to over-trade out of sheer boredom.

Asian markets closed mixed over-night and currently European markets are mixed and mostly flat as it seems the entire world is watching and waiting. Currently the futures are pointing to a modestly lower open having recovered about 50% from their overnight lows. Perhaps earnings and economic reports can break the logjam this morning and we can pick a direction. If not it would be wise to remember that really big moves often happen overnight on news events. Over-trade a dull market and you can easily find yourself on the wrong side of the move. Plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.