After more than a month and a half bull run the bulls continue to show resiliency fighting hard yesterday after a very disappointing retail sales report. Overnight future traded into the red as the Asian markets reacted to the possibility of a slowing US Economy but this morning the futures have recovered pointing to modest bullish open.

Take a look at the weekly index charts with our a single down candle since 12/28/18 with the Dow nearly 3700 points off the low and the SP-500 nearly 400 points higher. Truly an amazing rally that has provided traders with fantastic gains. Considering that as we head into the weekend be careful not chase entries this late into the rally and remember to take some profits.

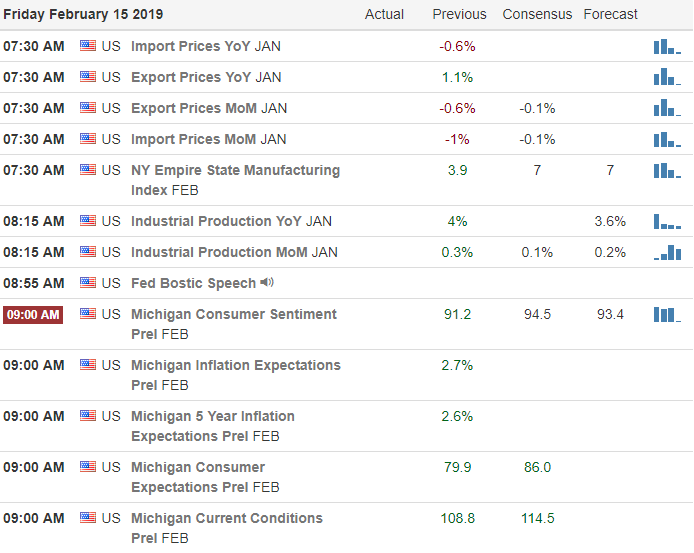

On the Calendar

On the Earnings Calendar we get a little break today with only about 50 companies fessing up to earnings results. Notable reports DE, MCD, NWL, PEP, RBS, YNDX.

Action Plan

After a disappointing Retail Sales report and discovering that the President is planning to declare a national emergency the market dipped slightly to end the day. However, the bulls fought back hard all day long choosing to ignore the data with amazing resiliency. Ironically Asian markets traded lower across the board in response to a slowing US Economy and overnight US Futures traded into the red. Once again the bulls refuse to lose and this morning the as I write the morning note, futures markets are pointing to modest gains at the open.

There is no doubt that the index trends are still up and although they appear stretched and losing price momentum more upside is certainly possible driven by earnings results. As we head toward the weekend remember to take some profits and evaluate the level of risk you will hold through the weekend. We have had an incredible month and a half bull run providing great profits, don’t give it back by chasing entries so late in the rally. Have a great weekend everyone!

Trade Wisely,

Doug

Comments are closed.