In an amazing show strength, the Bulls refused to give an inch and ultimately defied gravity pushing upward right into the close. In the shadow of GOOG earnings that seemed to disappoint investors and ahead of State of the Union Address that may prove to be controversial the futures market currently points to yet another gap up open. Go Bulls!

As much as my current long positions are benefiting from the bullish activity adding new risk so late in the rally should be carefully considered. The fear of missing out is a strong emotion that often causes traders to abandon their discipline and blindly chase into positions without consideration to risk or price resistance. The market can certainly continue to rally from here, but it’s very important to plan acceptable risk trades and avoid chasing.

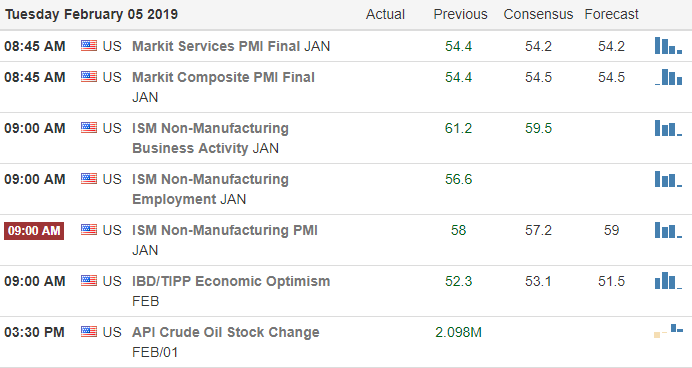

On the Calendar

On the Earnings Calendar, earnings reports ramp up today with 150 companies reporting. Among the notable reports: ALL, APC, ADM, BDX, BP, CNC, DLR, EA, EL, LAZ, PBI, RL, SNAP, VIAB & DIS.

Action Plan

The Bulls refused to lose continuing to defy gravity with Dow closing up 175 points. During the evening Futures were lower as earnings from GOOG, GLUU, GILD and STX disappointed investors. Surprisingly futures shook off the disappointment around 2:00 AM and began to rally strongly and have not looked back since. As I write this, ahead of many of the morning earnings reports, futures are suggesting a gap up open of more than 75 points.

Tonight is the delayed State of the Union address in which there is speculation that the President will declare a National Emergency to fund the border wall without Congressional approval. Should that occur, it will most certainly set off a firestorm of controversy that could affect the overall market. Pop some corn, put your feet and watch the show! Though my long positions are likely to benefit from this morning bullishness, I will not chase entries so late in this rally. If you do decide to enter new risk today make sure you wait for proof that buyers are in support of the morning gap.

Trade Wisely,

Doug

Comments are closed.