Good earnings and a wait and see FOMC inspired a bullish surge propelling the DOW upward, testing 25,000, a key psychological level for the index. The question now is will it hold as resistance or can the bull continue to defy gravity, fueled by earnings results and momentum. Today we have over 140 companies reporting and big economic reports for the market to decipher.

Asian markets closed higher across the board last night reacting to the rate decision by the FOMC. European markets are also bullish this morning, but US futures seem to be taking more of a wait and see approach showing the possibility of a flat to a mixed open as I write this. Currently, price action in the charts shows no sign of profit-taking, but after such a steep rally it should be no surprise if a pullback begins at any time. This has been a fantastic market run so remember to take some profits and have a plan if the market happens to shift south.

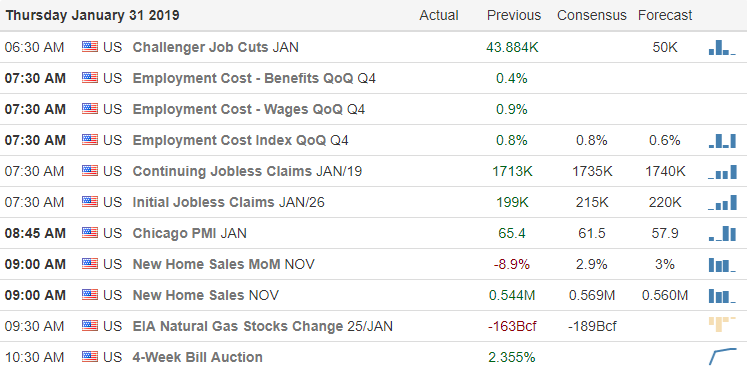

On the Calendar

Today on the Earnings Calendar we have 142 companies reporting earnings. Some are the notable are AMZN, MO, COP, DECK, DWDP, GE, HSY, MCK, SHW, TSCO & VLO.

Action Plan

An outstanding day yesterday as earnings and the FOMC inspire the bull to rally the Dow 434.90 points higher at the close. Both AAPL and MSFT, tech bellwethers, beat on the top line by a penny this week with one moving higher and the other lower. Today after the bell we have the retail giant AMZN reporting with a slew of other reports to keep traders guessing and on their toes as to what happens next.

The question now in my mind after such a huge run up the last few weeks how much longer can this continue? The T2122 indicator seems stretched to its limit suggesting we should be cautious that a pullback could begin at any time. However, earnings and shear bullish momentum can continue to carry the market higher as long a nothing stumbles. The Dow is once again testing 25,000 which has served as a key psychological level for the market. The question now is will it serve as resistance or can it break-through and once again serve as support. The current price action shows no clues of profit-taking just yet so stay long, but, I think it would be wise to prepare for the possibility.

Trade Wisely,

Doug

Comments are closed.