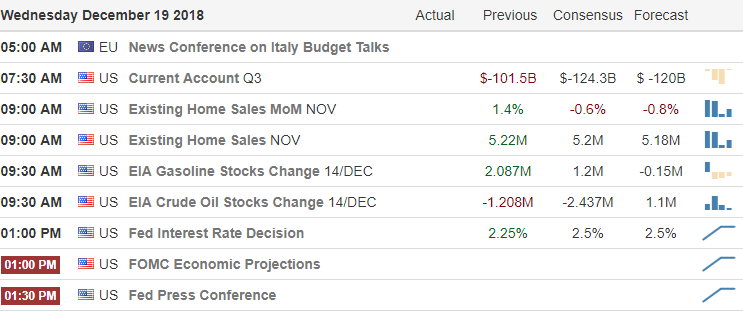

The question of the day, What will the FOMC decide at 2:00 PM ET time today? The world is watching, and pressure continues to mount as the WSJ the president and even Cramer have chimed in that the Fed should not raise rates. However,the Fed Funds Futures suggest that there is better than a 70% chance that the FOMC will stick to its plans increasing the rate by 25 basis points. Then there is the question of the FOMC forecast? Will they continue with their aggressively hawkish stance or will they soften their outlook with a more dovish look forward.

As a trader, the truth is it really doesn’t matter what the Fed does or doesn’t do. What matters is how the market responds to their decision and how we as traders react the price action. Currently, the Dow Futures indicate a substantial gap up of nearly 200 points. We should expect substantial volatility and watch for possible full whipsaw reveals as we wait for the FOMC decision. After the decision expect tremendously violent price swings, the market reacts all the way through the Chairman’s press conference. Buckle up it could be a very bumpy ride!

On the Calendar

On the Earnings Calendar,we have 23 companies reporting earning stoday. Among those reporting are GIS, PAYX, PIR, RAD, WGO as some of the most notable.

Action Plan

A budget deal in Italy, some improvement in US budget negotiations and a possibly more accommodating FOMC is lifting the mood of US Futures this morning. As I write this futures are suggesting a triple point gap up at the open. The question is will the Bull be able to hold and defend the gap as we wait for the FOMC decision at 2:00 PM ET or will we continue whipsaw? We should expect a volatile day and if you decide to trade plan to be very nimble and a substantial tolerance to risk.

Fed fund futures indicate better than a 70% chance that the FOMC will follow-through on their plans to raise interest rates by 25 basis points. If they do, does mean the market will necessarily fall? No. However, it will require to Fed to sound much more dovish in their forecast. With the current state of the market, there is, of course, tremendous anticipation surrounding this event. Expect extreme price volatility after the release the may reverse directions several times all the way through the chairman’s press conference.

Trade wisely,

Doug

Comments are closed.