Grinch Who Stole Christmas

US/China trade war concerns, sharply falling oil prices and the arrest of a Chinese tech CEO may have combined as the Grinch Who Stole Christmas. Asian stocks declined sharply overnight, and European markets are currently sharply lower across the board this morning. As a result, the Dow Futures are pointing to 400 point gap down at the open. The market hates uncertainty, and until we get some resolution on some of this politically generated uncertainty, this roller-coaster ride of market volatility is likely to continue. It seems hard to believe that it was just Monday we were looking futures gaping up 450 points.

US/China trade war concerns, sharply falling oil prices and the arrest of a Chinese tech CEO may have combined as the Grinch Who Stole Christmas. Asian stocks declined sharply overnight, and European markets are currently sharply lower across the board this morning. As a result, the Dow Futures are pointing to 400 point gap down at the open. The market hates uncertainty, and until we get some resolution on some of this politically generated uncertainty, this roller-coaster ride of market volatility is likely to continue. It seems hard to believe that it was just Monday we were looking futures gaping up 450 points.

Remember when the market is thrashing around like this you are not required to trade! As a trading coach, I’ve talked with a lot of traders that wish they would have taken the month of November off because it would have saved them a bucket load of capital. Only trade when you have an edge. If you are consistently losing money stop trading! The market will eventually calm down, and your edge will return, but if you lose your capital to this very emotional market, you could be out of business before that happens. It’s not personal its business and you have to know when the risks are just too high. Stay calm, disciplined and focused on price action.

On the Calendar

On the Earnings Calendar, we have 57 companies reporting results today. Make sure to do your due diligence.

Action Plan

This morning we face a very ugly market open, and it looks as if the Grinch really has stolen Christmas this year. On Tuesday the 3-year bond yields rose the 5-year yield which is known as a yield curve inversion. Although the market reacted in a very negative way, typically a true yield curve inversion requires the 2-year bond yields to rise above 10-year which of course has not happened as of now. The US/China trade deal may have just become much more complicated as the CEO of a China tech company was arrested in Canada at the request of US. Also, this morning oil prices are sharply lower as OPEC production cutbacks were less than expected.

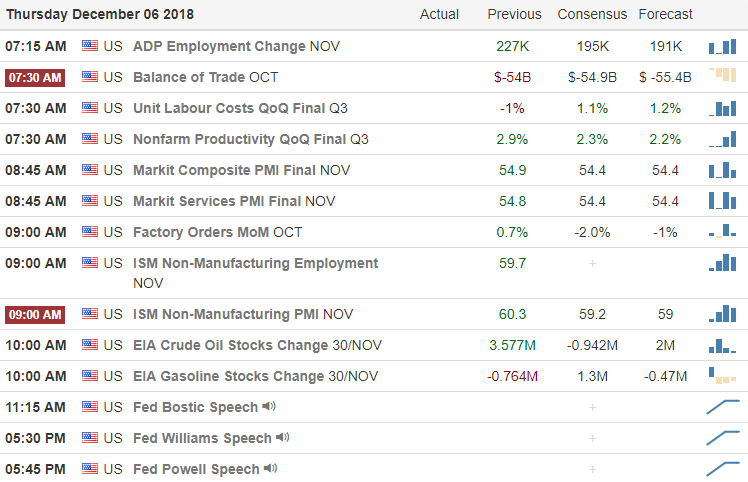

While it may seem like the sky is falling this morning, we must say calm, disciplined and focused on price action. We have a huge economic calendar today that could easily improve the or worsen the situation throughout the day. However, if we become compromised emotionally, then we risk missing out on the potential opportunities that could occur. Remember the high gap up on Monday found no buyers after the open. We must stay focused on price action waiting to see if the bears pile on after the open supporting the gap down or if the bulls step to defend price support and gobble up the bargain prices.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/cTeVAvgpNyw”]Morning Market Prep Video[/button_2]

Comments are closed.