Risk of the G20

Unable to follow through on Wednesday’s momentum traders face some difficult decisions as we head into the weekend and the outcome risk of the G20 meeting. Will the US and China kiss and makeup or will the tensions between the only increase when the tow very stubborn leaders meet? Unfortunately, the answer to that question will happen over the weekend. Will you accept the additional risk of holding into the weekend or will you choose close positions to avoid the unknown?

Unable to follow through on Wednesday’s momentum traders face some difficult decisions as we head into the weekend and the outcome risk of the G20 meeting. Will the US and China kiss and makeup or will the tensions between the only increase when the tow very stubborn leaders meet? Unfortunately, the answer to that question will happen over the weekend. Will you accept the additional risk of holding into the weekend or will you choose close positions to avoid the unknown?

If you look at the index charts from a technical perspective, they are at a critical point of decision. Can they break through the downtrend resistance or will they fail, creating yet another higher low an increasing the technical damage. A tough call for sure and the fact that futures are pointing to a triple point gap down this morning does not make that decision any easier! No matter what you decide to go into the weekend with your eye’s wide open about the potential risks or rewards depending on the outcome of the G20 meeting.

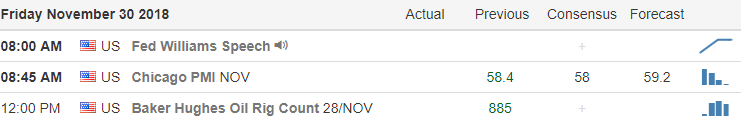

On the Calendar

On the Earnings Calendar, we have only 17 companies reporting as we slide into the weekend.

Action Plan

For a brief time yesterday, it looked as if the momentum of Wednesday would win the day but sadly heading into the close indexes slipped back into the red. Now the will market look to the G20 meeting for inspiration, but unfortunately, the outcome of that meeting will occur of the weekend. This morning futures are suggesting a triple point gap down amid swirling speculation of the possible outcome. The question for today is will we see follow-through selling after the open with traders avoiding the weekend risk or will volume simply dry up as we wait?

Technically speaking even after the big Wednesday rally the indexes are still in a downtrend. A failure at or near the downtrend could create more technical damage and raise concerns of yet another test of the lows. Keep an on the VIX for clues of fear creeping back in the mind of the market. Honestly, I hope cooler heads prevail, and we simply slide quietly into the weekend as we wait. However, putting our head in the sand an not preparing for all possibilities is irresponsible. Stay focused on the price action after the morning rush for clues and consider the risk carefully as we head into the weekend.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/Thk5-3hBvTw”]Morning Market Prep Video[/button_2]

Comments are closed.