Follow-Through?

After the big gap and rally yesterday I was hoping for a little follow-through today, but a little profit taking would not be that unusual. So far this morning presidential trade war threats have trumped the record-breaking Cyber Monday sales event. (pun intended) As a result, AAPL is under a little pressure this morning as the hits keep on coming for the battered tech sector.

After the big gap and rally yesterday I was hoping for a little follow-through today, but a little profit taking would not be that unusual. So far this morning presidential trade war threats have trumped the record-breaking Cyber Monday sales event. (pun intended) As a result, AAPL is under a little pressure this morning as the hits keep on coming for the battered tech sector.

If the Bulls can defend yesterday’s low in the QQQ’s, then the strong holiday sales should extend the relief rally. However, if the Bears are allowed to breach yesterday’s index lows fear could easily win the day, and a retest of last Tuesdays low would not be out of the question. Volume should return of the next few days so be patient, disciplined and focused on price action. We all want to see the market recover but what we want is not important. See the chart for what it is not as we want it to be!

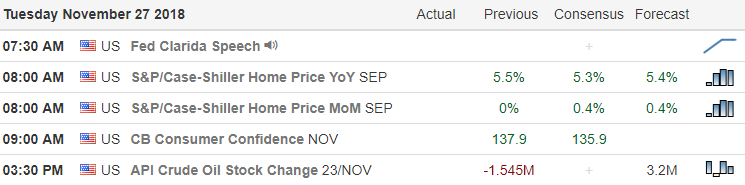

On the Calendar

On the Earnings Calendar, we have 33 companies reporting result today.

Action Plan

The online shoppers worked hard all day yesterday increasing yesterdays Cyber Monday sales by nearly 20% over last year and setting new records. Now that the Thanksgiving shopping events are over and vacations ending volume should begin to return over the next couple of days. Unfortunately, futures are pointing to modest gap down this morning with the president threatening tariffs on all imported iPhone’s from China. Consequently, AAPL is under a little pressure this morning putting even more pressure on the already vulnerable tech sector.

After such a big rally yesterday some profit taking would be normal but if the sellers breach yesterday’s low a retest of last Tuesday’s could be possible. However, if the bulls can defend yesterday’s low’s then a move higher to test resistance seems likely assuming trade war rhetoric doesn’t get in the way. Be patient, flexible and focused on price action without bias, remembering there is no need to rush to a trade. The volume will return, but I would not be at all surprised if it does so slowly over the next few days.

Trade Wisely,

Doug

Comments are closed.