Negative Territory

Another nasty day of selling in the tech sector, breaking below Octobers low, and lead the overall market into negative territory for the year. On the positive side the DIA, SPY, and IWM managed to hold at the support of Octobers low, but there is so much technical damage in the charts its difficult to call that victory. Both the QQQ and the SPY are at risk of joining the IWM with their 50-day averages crossing below the 200-day averages in the very near future. The so-called death cross.

Another nasty day of selling in the tech sector, breaking below Octobers low, and lead the overall market into negative territory for the year. On the positive side the DIA, SPY, and IWM managed to hold at the support of Octobers low, but there is so much technical damage in the charts its difficult to call that victory. Both the QQQ and the SPY are at risk of joining the IWM with their 50-day averages crossing below the 200-day averages in the very near future. The so-called death cross.

Yesterday before the market had even closed there were traders predicting this is the bottom. Really? Yes, this could be a bottom, and this morning we are getting a nice oversold bounce but consider the fact it may be just a resting point before resuming the downtrend. See the price action for what it is not for what you want it to be! Gamble and you may win, but you have an equal chance of just providing liquidity. Remember volume is likely to decline sharply after the morning rush so plans your risk into the holiday carefully! I wish you all the very best and Happy Thanksgiving.

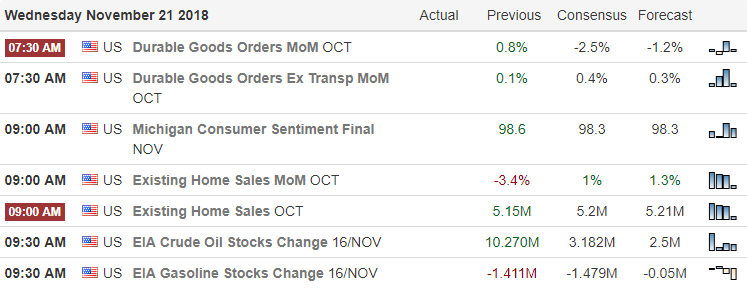

On the Calendar

On the Earnings Calendar, we have less than 40 companies reporting earnings as we head into the holiday. Notable reports today are ADSK, BILI, BJ, BZUN, CPRT, DE, FL, GPS, KEYS, SE.

Action Plan

After yesterdays nasty gap down and selloff, the indices are once again in negative territory for the year. Now the question is will the October lows hold as the price support for the DIA, SPY, and IWM? The QQQ’s yesterday broke support creating yet another layer of resistance as the tech sector continues to slide lower. This morning futures are suggesting a bounce this morning, and I’m already seeing traders trying to predict that this is the bottom.

After sliding 1000 points in just two days, it might be wise to consider that this mornings rally is merely a short-term oversold rally! Sure you could gamble and win but its still a straight up gamble nothing more! We have a very busy economic calendar this morning and some important earnings reports, but after the morning rush volume is likely to drop quickly as traders head out for their holiday plans. I want to wish every one of you a very Happy Thanksgiving!

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/QlWMHLIWkiY”]Morning Market Prep Video[/button_2]

Comments are closed.