Choppy Holiday Price Action

Thanksgiving vacations, Black Friday and Cyber Monday typically set the stage for choppy holiday price action. There are a lot of good-looking charts showing up after the rally relief last Thursday and Friday, but as the holiday nears they may find it difficult to find the energy follow-through. Of course, news such as a China trade deal would be a game changer but short of something like that this could be a challenging week.

Thanksgiving vacations, Black Friday and Cyber Monday typically set the stage for choppy holiday price action. There are a lot of good-looking charts showing up after the rally relief last Thursday and Friday, but as the holiday nears they may find it difficult to find the energy follow-through. Of course, news such as a China trade deal would be a game changer but short of something like that this could be a challenging week.

You may have to very flexible and nimble willing to taking profits and cutting losers quickly. After the morning rush on Wednesday expect volume to drop like a rock unless driven by a surprise new event. Expect choppy price action on the half day of Black Friday trading and the Cyber Monday holiday sales events. If you’re heading out early for your holiday plans, I want to wish you safe travel and a very Happy Thanksgiving!

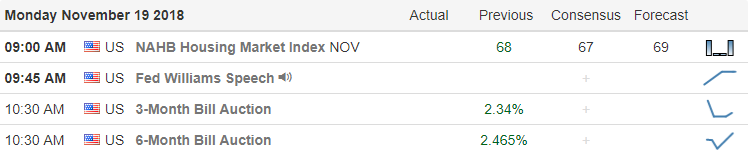

On the Calendar

There are 66 companies reporting earnings today. Notables today are AABA and JD which both report before the bell this morning.

Action Plan

Major holidays weeks typically see a significant decline in volume adding an additional challenge to our trading. We may find plenty of good long and short entry signals, but they may lack the energy to follow-through and profit. Thursday the market is closed, and Friday it’s only open half a day. In the past, both Black Friday and Cyber Monday are also light volume days with everyone focuses on the holiday shopping deals and travel.

Futures are suggesting a slightly bearish open with the Dow currently indicated to gap down about 75 points. Asian and European markets were bullish overnight. Because of the risks of holding over a holiday weekend, if I do trade, I will plan to take profits quickly and cut losers without mercy. I intend to be light in my portfolio on swing trades by Wednesday and will most likely stay that way until next week. If the holiday sales events go well then perhaps Santa can begin working his magic by next week. If sales disappoint, then watch the emergence of the Grinch.

Trade Wisely,

Doug

Comments are closed.