Market Bias

Is your market bias robbing you of profits? As a trading coach, I answer questions almost every day from traders that fail to see the price action clue in the chart due to bias. Perma-bulls dreaming of a Santa Clause rally, fail to see the possibility of a pullback even after a 2000 point rally in just 8-days. Perma-bears are just as negligent believing that the market has gone up so much that it has to come down. Have you ever failed to close position moving strongly against you because, darn it, you have to be right!

Is your market bias robbing you of profits? As a trading coach, I answer questions almost every day from traders that fail to see the price action clue in the chart due to bias. Perma-bulls dreaming of a Santa Clause rally, fail to see the possibility of a pullback even after a 2000 point rally in just 8-days. Perma-bears are just as negligent believing that the market has gone up so much that it has to come down. Have you ever failed to close position moving strongly against you because, darn it, you have to be right!

We all have, and that’s just one clue that bias is keeping you from success. Fighting the market is an exercise in futility! The truth is the market could care less what you think you know about technical analysis, candle patterns or indicators. Set your bias aside and take the time to study the price action of the chart. The clues are always there if your bias is not in the way clouding your view of the price action.

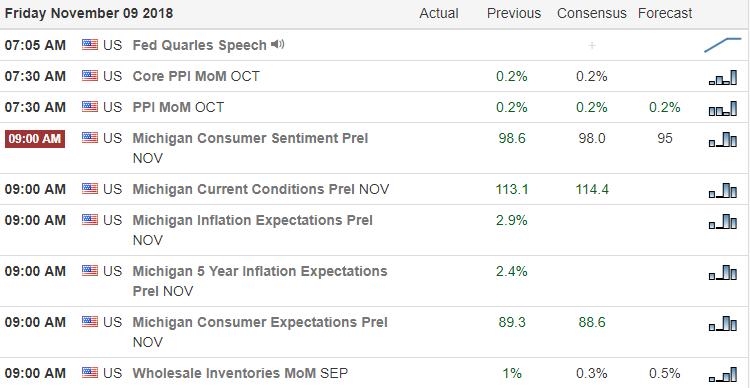

On the Calendar

With the majority of earnings reports completed for this quarter, the number of reports will begin to drop significantly. Today there are 119 companies reporting.

Action Plan

Selling in Asian markets overnight has translated into European market also lower across the board this morning. As a result, US Futures which held up quite well most of the night began to react very negatively early in the morning. As I write this, the Dow is indicated to gap sharply lower in response. However, a pullback after such a steep rally is not a surprise, and I expect many traders are already short in anticipation.

At the close yesterday, the VIX was beginning to respond to price support. The gap down this morning could once again bring some fear into play so plan for volatility to remain elevated. With the FOMC indicating another rate hike next month and the ongoing uncertainty of China trade negotiations, a substantial market pullback is possible. Unfortunately, due to the huge rally, finding support could mean a nasty swing lower. Let’s hope all the market needs is a restful consolidation! Stay focused on price action and as we head into the weekend, plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.