All the uncertainty about the pandemic business impacts will begin to come to light with the kickoff of 2nd quarter earnings. With there will be companies that have benefited from the pandemic, most will likely suffer profound impacts. Expect significant volatility, stick to your rules, and stay focused on price action. Trying to predict and biased trading with so much uncertainty will be very dangerous.

Asian markets closed in the green across the board last night as Chinese exports fall less than expected. European markets are flat to slightly positive this morning as they mull a lock-down exit strategy. US Futures put on a brave face ahead of the earnings kickoff, pointing to a substantial gap up open. Tighten your seat-belt; this could be a wild ride!

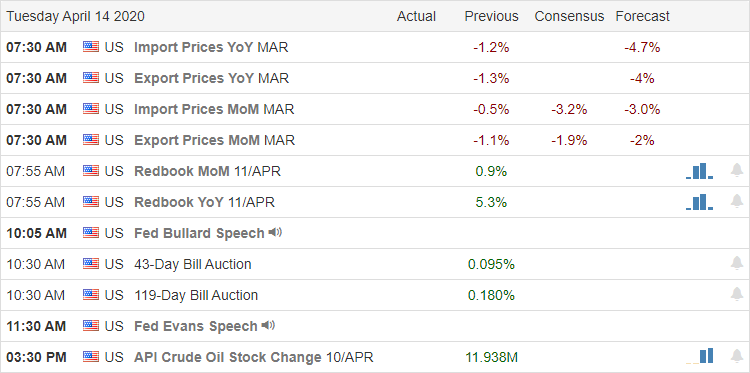

Economic Calendar

Earnings Calendar

Today we begin the 2nd quarter earnings calendar with more than 70 companies reporting. Notable reports include JNJ, JPM, FAST, INFY, JBHT, and WFC.

Top Stories

While US officials talk about reopening the country, the UK is likely to extend the lockdown. Cases in Germany jump by more than 2000, Singapore reported 386 new cases. India continued its lockdown until May 3rd, with Russia hitting a new record in daily infections of 2774. There are now nearly 2 million cases worldwide with the virus as the US quickly approaches 600,000 infections.

JPM reports this morning, but one has to wonder with such uncertainty looking forward, how the numbers can be meaningful. The SEC has told companies not to be too concerned if their guidance changes rapidly, and some have suggested that may companies will suspend guidance altogether.

Technically Speaking

After an uncertain and choppy day of price action, the overnight futures market surges upward ahead of the 2nd quarter earnings season kickoff. With the Fed seemingly buying up everything in sight, including junk bonds to bolster the market, it would appear they are worried about the earnings season. While fighting the Fed is a bad idea, it’s hard to imagine that company earnings could be anything other than dismal. With there will be companies such as AMZN, WMT, KR & COST that may well benefit from the lockdown, the vast majority have suffered devastating impacts. Expect this earnings season to be extremely volatile. One thing for sure it won’t be boring!

The current bullish short-trends are holding support levels, but the potential for big price moves add significant risk to an already very challenging market condition. While there is tremendous hope we have seen the worst of this crisis, we can not rule out the possibility of another test lower as the real business impacts are finally revealed. What we want to happen or what we might think will happen doesn’t matter. What matters is that we set aside our bias, focus on the price action remaining disciplined to our trading plan and rules to ride out this earnings season with success.

Trade Wisely,

Doug

Comments are closed.