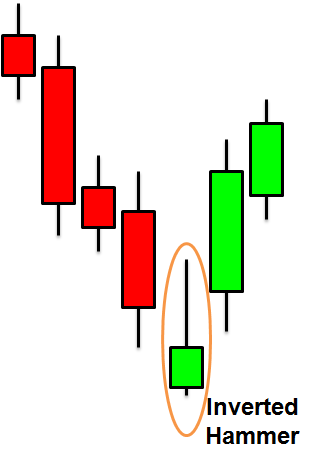

If you flip the Hammer candlestick on its head, the result becomes the (aptly named) Inverted Hammer candlestick pattern. Like the Hammer, the Inverted Hammer occurs after a downtrend, and it also has one long shadow and one nonexistent (or very short) shadow. Plus, they’re both bullish reversal patterns formed with just one candle! The key to identifying a Hammer versus an Inverted Hammer is the location of the long shadow. A Hammer’s long shadow extends from the bottom of the body, while an Inverted Hammer’s long shadow projects from the top. To learn a little more about this common reversal pattern, please scroll down.

Inverted Hammer Candlestick Pattern

Formation

Like several other candlestick patterns (Hammer, Hanging Man, Shooting Star), the Inverted Hammer is composed of only one candlestick, but it needs support from surrounding candlesticks in order to exist. If you’re trying to identify an Inverted Hammer candlestick pattern, look for the following criteria:

First, the candle must occur after a downtrend. Second, the upper shadow must be at least two times the size of the real body. Third, the lower shadow should either not exist or be very, very small. Fourth, the real body should be located at the lower end of the trading range. The color of this small body isn’t important, though (as you’ll see below) the color can suggest slightly more bullish or bearish implications.

Meaning

At first, due to the gap down at the open, it seems that the downtrend will continue and the price will drop further. The atmosphere is bearish. Although the bulls step in and rally the prices up briefly, they’re weak and the price is ultimately pushed very low, closing near to where it opened. To confirm that a bullish reversal will occur, check for a higher open during the next trading period.

To learn a little more about this bullish reversal pattern, look for the following characteristics:

- The longer the upper shadow, the more likely it is that a reversal will occur.

- A gap down from the previous day’s close sets up a stronger reversal.

- Large volume on the day the Inverted Hammer occurs increases the likelihood that a blowoff day has occurred.

- A white body has more bullish implications. A black body has more bearish implications.

– – – – –

If you flip an Inverted Hammer upside down, it becomes a Hammer candlestick, and if you maintain its appearance but place it at the end of an uptrend, it becomes a Shooting Star. So if you’re new to Japanese candlesticks, take your time when identifying this tricky reversal pattern. Also, to confirm that an Inverted Hammer candlestick pattern has occurred, check that the price trades above the body on the following day before you take action. Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.